SIP Calculator - Lumpsum

SIP Calculator helps you to analyses your investments or plan for new investments.

SIP Calculator

calculates the future value of SIP (Systematic Investment Plan) Payments.

SIP Planner

Helps you assess how much you should invest every month to get a desired amount at the end of an investment period.

Lumpsum

Mutual fund investors can use this calculator to figure out the estimated returns on their investments. Before getting into the benefits of using this calculator, one must know the types of return for a lumpsum investment.

What is SIP

SIP stands for Systematic Investment Plan. With SIP you can invest a small amount into mutual funds on a monthly basis. This is preferable mode of investment for many especially salaried people.

This smart and handy SIP calculator app calculate future value of your monthly investment in Mutual Fund, Public Provided Fund (PPF) or Fixed Deposit (FD) in bank or post office.It is very useful in planning for your long term financial goal like buying car, house or any other stuff.

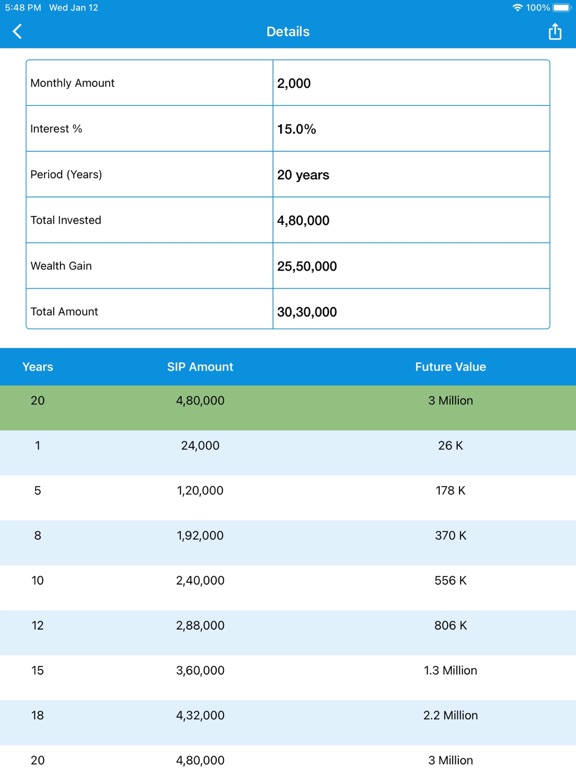

Systematic Investment Plan (SIP) is a investment scheme offered by mutual fund companies.This SIP calculator helps you calculate the profit gain and returns expected for your monthly SIP investment. You get a rough estimate on the maturity amount for any monthly SIP, based on a projected annual return rate.

Just enter your Monthly Invested amount, Investment period and Expected return rate percentage (%) and this app will calculate the current value of your deposit and this will also show the final amount of your saving at the end of your invested period.

Features :

- Easy and fast way to calculate your SIP

- Maintain history of different plan and view them at any time.

- Save & Share SIP details with clients in PDF format using SMS/EMAIL.

- App Available for FREE to use.

Benefits of SIP :

1) You can start investing with a small amount

2) Lower market risk with the help of averaging

3) Higher returns with the power of compounding

4) Save income tax by investing in tax saving mutual funds and SIP plans